2023 saw Brazil, the world’s most promising new gambling market, change nicknames from “sleeping giant” to “a dreamland for gaming operators.” Slotegrator experts and media partners shared their key insights into this exciting new market.

Brazil caused a massive stir at the end of 2023 when the country finally regulated online sports betting — and, somewhat unexpectedly, casino gaming. The approval follows the passage of Bill 3.626/2023, passed in 2018, which legalized sports betting but did not provide regulations. Ultimately, regulations were approved after a vigorous debate in a plenary session of the Chamber of Deputies.

It is forecasted that in the next three years, revenues from the Brazilian sports betting and online casino market will exceed 100 billion Brazilian reals ($200.4 million). This revenue, expected to be primarily generated through tourism, is one reason so many online casino and sportsbook operators are considering investing in the country’s gambling market.

Flavio Figueiredo, founder and CEO of media outlet iGaming Brazil, Slotegrator’s media partner, comments: “During this long regulatory process, there were several changes, several bills and, in my opinion, there are still points that need to be improved, but the important thing at this moment is to regulate, put the ball in play, and address the needs as they happen. Working in a regulated market brings much more security to companies operating in the sector, as well as credibility to the player who bets.”

As a promising market where operators would do best to get started now and be ready for any possible changes in the future, Brazil is perfectly suited to modern platform software with maximum flexibility and a unified back office, like Slotegrator’s turnkey solution. The platform has a range of powerful modules, including the capacity to customize multiple front ends — perfect for a project facing multiple markets.

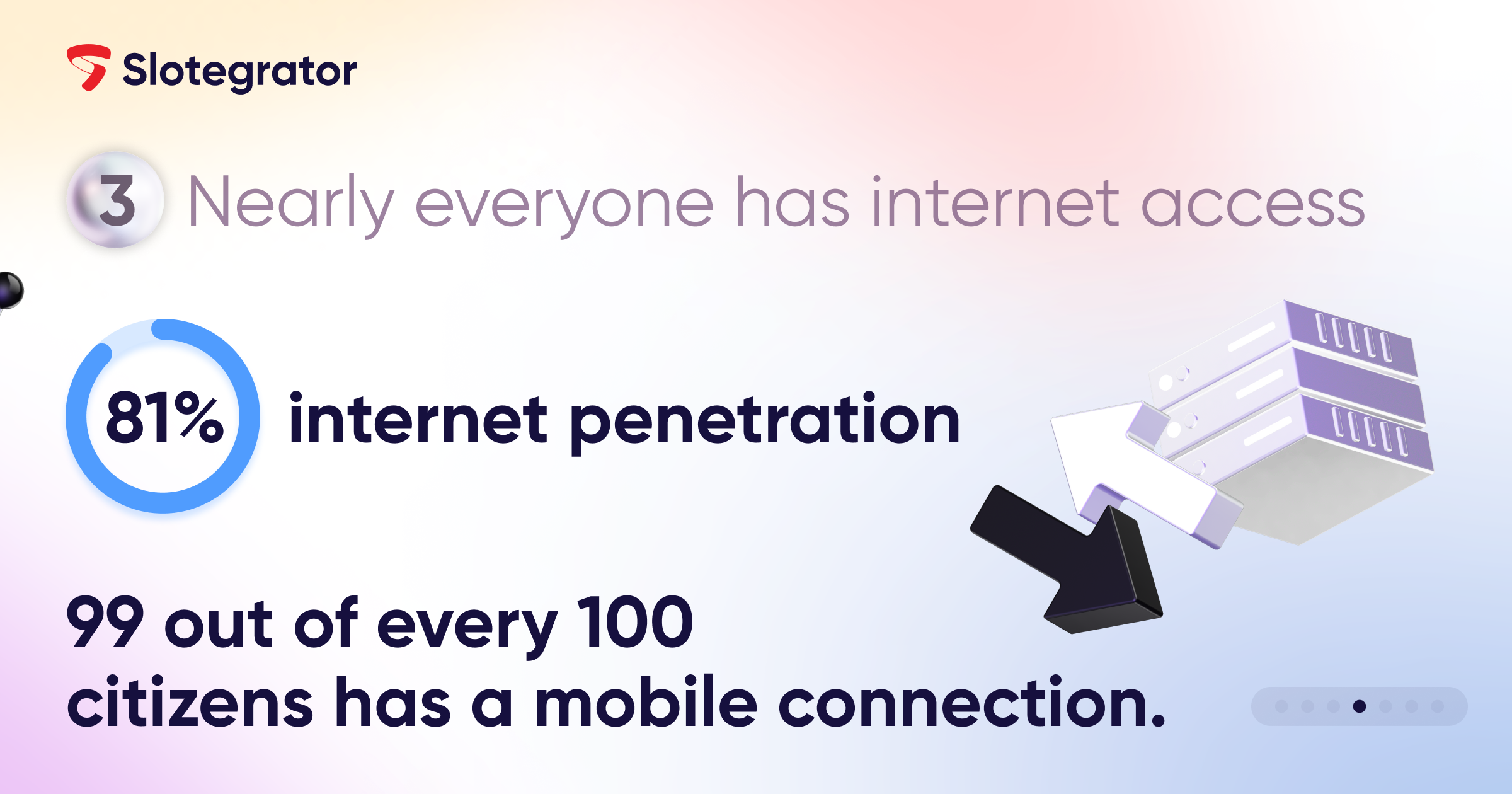

Ayvar Gabidullin, business development manager at Slotegrator, comments that it is an advanced solution for operators that have a great desire to be in this market but are keen to avoid exorbitant investments in a completely new market for them. Slotegrator experts also note the rising interest in mobile games, which is no surprise considering the country’s communications infrastructure; with 81% internet penetration and 99 out of 100 citizens using a mobile connection, there’s barely a Brazilian who doesn’t have access to the internet somehow, and it’s highly likely they’re doing so through a mobile phone.

When localizing a platform, it’s essential to take into account all regulations, including those related to advertising. “Brazil has a market with an annual projection of R $100 billion (approximately €18.5 billion), which would be a gold mine in any field of activity. No wonder the world is keeping an eye on the country. The forecast is that these numbers will grow even more with the regulated market and even more aggressive advertising, for example,” emphasizes Flavio Figueiredo, founder and CEO of iGaming Brazil.

The changes have not only had an impact on the regulatory framework; advertising has also been in the spotlight.

The gaming legislation of 2023 also outlines regulations for gaming promotions. Its framework includes:

- Rules for communication, promotion, and marketing, primarily advocating for self-governance.

- Compulsory incorporation of alerts regarding the hazards of promoted activities.

- Ban on deceptive promotion, endorsement of unlicensed trademarks, or inaccurate advantages.

- Clear prohibition of directing advertising towards minors (such as advertising in educational institutions) and requirements for appropriate age group identification.

What do operators need to consider before entering the market? Here, we’ll turn to comments from Fernando Saffores, founder and director of the media outlet Focus Gaming, Slotegrator’s media partner:

“Let’s split both questions into different topics:

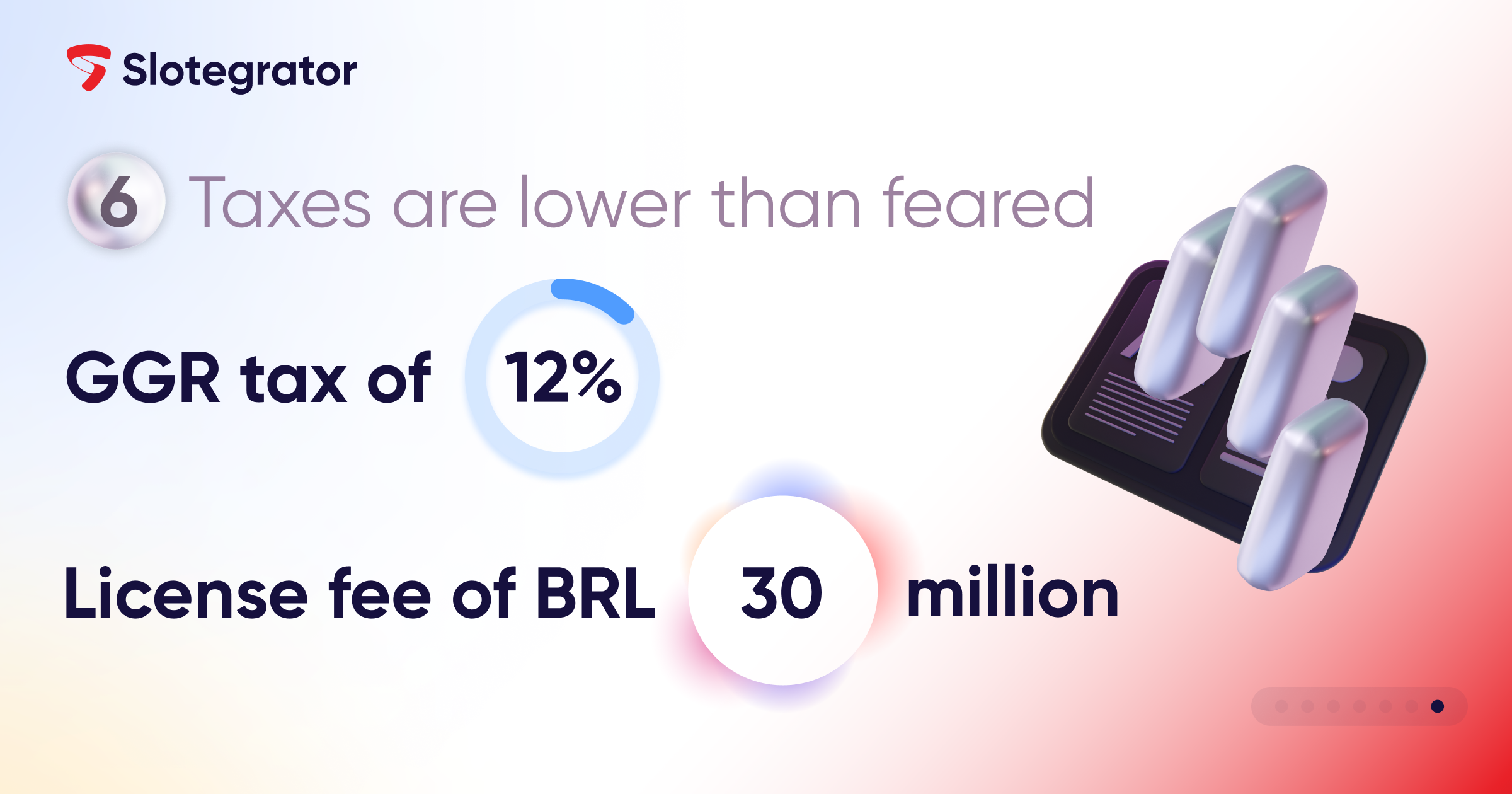

- Regulatory Framework: Evaluate the clarity and comprehensiveness of the regulatory framework. Assess how well it addresses key aspects such as licensing, taxation, and consumer protection.

- Enforcement Mechanisms: Look into the effectiveness of the supervisory body (SPA) and its sub-secretariats. Assess their capabilities in monitoring, preventing money laundering, ensuring compliance, and promoting responsible gambling.

- Collaboration: Examine the collaboration between the SPA and the Ministry of Sports. This partnership is crucial for safeguarding sporting integrity, and its effectiveness will impact the overall success of the regulatory framework.

- Operator Interest: Consider the level of interest from operators. High interest may indicate confidence in the market, but it’s essential to monitor how these operators contribute to responsible gaming and regulatory compliance.”

And a little bit about expectations from the Brazilian market. What should operators get ready for?

Saffores thinks that it’s important to note that the success of the market will depend on effective implementation, ongoing monitoring, and adaptability to challenges that may arise. According to him, there need to be international comparisons: “Look at experiences from other countries with similar regulatory frameworks. Assess how those markets evolved, the challenges they faced, and the lessons learned.” Saffores also mentions economic impact: “Analyze the potential economic impact of the regulated market, including tax revenues generated and job creation. Evaluate whether the framework supports sustainable economic development.”

Slotegrator experts recommend paying attention to the necessity of educating the Brazilian population about how the market is developing, what can and cannot be done, so that the market gets it right from the start.

Experts from Slotegrator Academy also prepared special infographics covering 6 things to know before starting an online sportsbook or casino in Brazil: